EURO FORECAST:

EURO FORECAST: NEUTRAL

- Dollar Index (DXY) Remains Key for EURUSD as a Host of Data Awaits from the US Just as Geopolitical Tensions Ratchet Up Ahead of the Weekend.

- Big Week on the Data Front as We Have Central Bank Meetings, NFP, Euro Area Inflation and GDP Data.

- The BoJ Interest Rate Decision Due Next Week as Well. WIll We Get Any Further Clarity on FX Intervention?

- To Learn More About Price Action,Chart PatternsandMoving Averages, Check out theDailyFX Education Series.

READ MORE: Short USD/JPY: A Reprieve in the DXY Rally and FX Intervention by the BoJ

WEEK IN REVIEW

It’s been a lackluster week for the Euro to say the least with the European Central Bank (ECB) monetary policy decision turning into somewhat of a ‘non-event’ this week. No significant change in the ECB outlook as President Lagarde reiterated the key talking points that have become all too familiar of late. The only slight change from President Lagarde was a more cautious tone when speaking about the economic outlook moving forward while she stressed the higher for longer narrative a bit more strongly than the September meeting.

Download the EURO Forecast for Q4 Now!

Looking broadly at the pause and comments from the ECB and I would have to say it does give me an impression of a dovish pause which could continue to weigh on the Euro moving forward. President Lagarde did refer to the recent macro data and signs of weakening in the labor market as disappointing. The President further stated that she expects monetary policy to continue to transmit to the economy in Q4 and into next year which opens the door for downward revisions in the ECB staff projections at the December meeting.

Interestingly enough the Euro did not lose a lot of ground following the ECB decision with EUR/USD gaining after a brief decline. This could also be down the dynamics of the US Dollar at present but following the significant selloff in the Euro of late, the question is how much lower can we go?

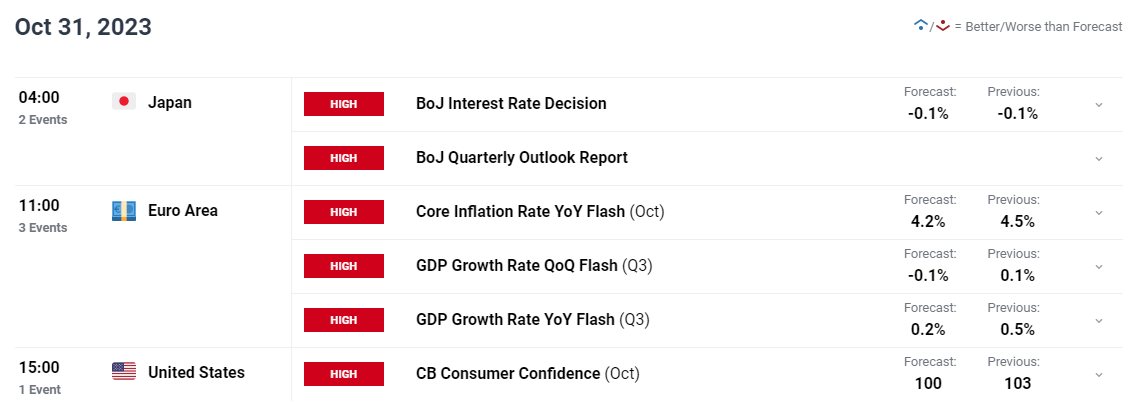

THE WEEK AHEAD: CENTRAL BANK MEETINGS, EURO AREA INFLATION AND GDP DATA

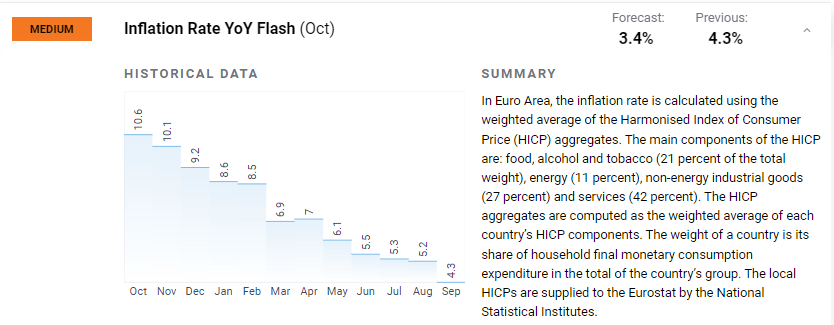

Give the diminishing growth prospects for the Euro Area the dovish outlook is not unwarranted but there are risks to inflation which could prompt a rethink from the Central Bank. The week ahead brings the Flash Inflation data for October as well as the QoQ GDP growth rate. Inflation will be key given the recent uptick in inflation could force the ECB to rethink their position or at least adopt a more hawkish rhetoric heading into the December meeting. Inflation is expected to have fallen with the MoM also set for a drop based on analyst forecasts.

Source: DailyFX Calendar

GDP will be an intriguing one as the Euro Area does appear to be grappling with stagflation at present. Market expectations are for a contraction of -0.1% QoQ with the YoY print expected to come in at 0.2%, down from the previous print of 0.5%. If the print comes in a lot worse than expected this could really add to the Euro Areas woes.

Other factors that could affect EUR/USD and EUR/JPY in the week ahead will come courtesy of the Federal Reserve monetary policy meeting. There should not be any surprises from the FOMC meeting especially given the spike in treasury yields. As mentioned by policymakers the rise in Yields is likely to do part of the Feds job which means we are likely in for another lackluster Central Bank meeting. There is also the belief that some of the tightening by the Fed has yet to be fully transmitted through to the economy. The NFP number will also be interesting following the massive beat last month, yet more important will undoubtedly be the average earnings number. Markets are expecting a drop off in the average earnings number which should be a positive for the Fed and provide another sign that price pressures are easing.

If you've been discouraged by trading losses, consider taking a proactive approach to boost your skills. Download our guide, "Traits of Successful Traders," and uncover a valuable collection of insights to help you steer clear of common trading pitfalls.

EUR/JPY will also face the interest rate decision from the Bank of Japan (BoJ) with no change expected in policy but further tweaks to YCC may still happen. We could also hear more on the potential FX intervention which continues to hang over Japanese Yen pairs. Comments are unlikely to cut it however, as we have heard the same comments from policymakers for months now which seems to have worn off.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

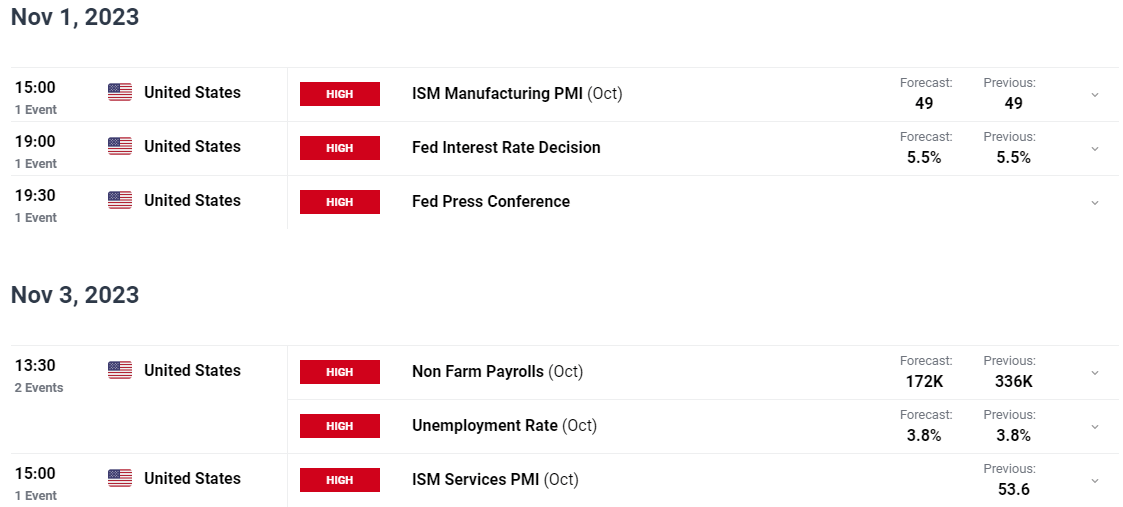

Looking at the technical perspective and EURJPY has been rangebound for the best part of 3 months between the 156.70-159.70 areas. Now this is a 300-odd pip range but EURJPY can do that in a day or two in a normal market environment. The threat of FX intervention has kept the Yen supported during this period while Euro weakness also played its part.

At this stage we do need some form of catalyst for a breakout whether in the form of FX intervention from the BoJ or any sign of a bullish resurgence in the Euro. Friday's daily candle is on course for a shooting star candle close which could hint at some bearish price action to start the week. In the absence of this i fear EURJPY may remain rangebound with short-term positions remaining the most appealing.

EUR/JPY Daily Chart – October 27, 2023

Source: TradingView

Key Levels to Keep an Eye On:

Support Levels

- 157.94

- 157.00

- 155.72

Resistance Levels

- 158.40

- 159.00

- 160.00

EURUSD

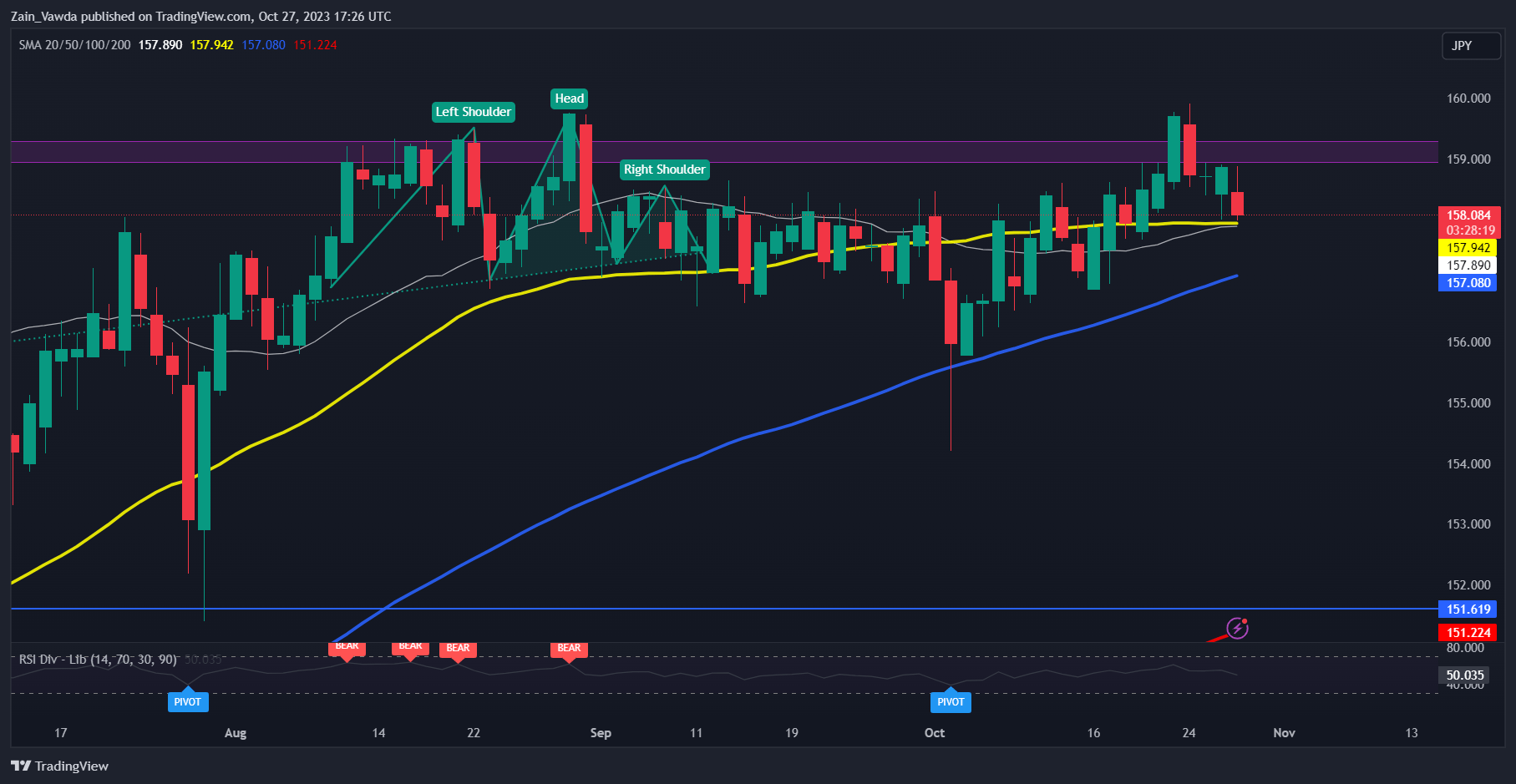

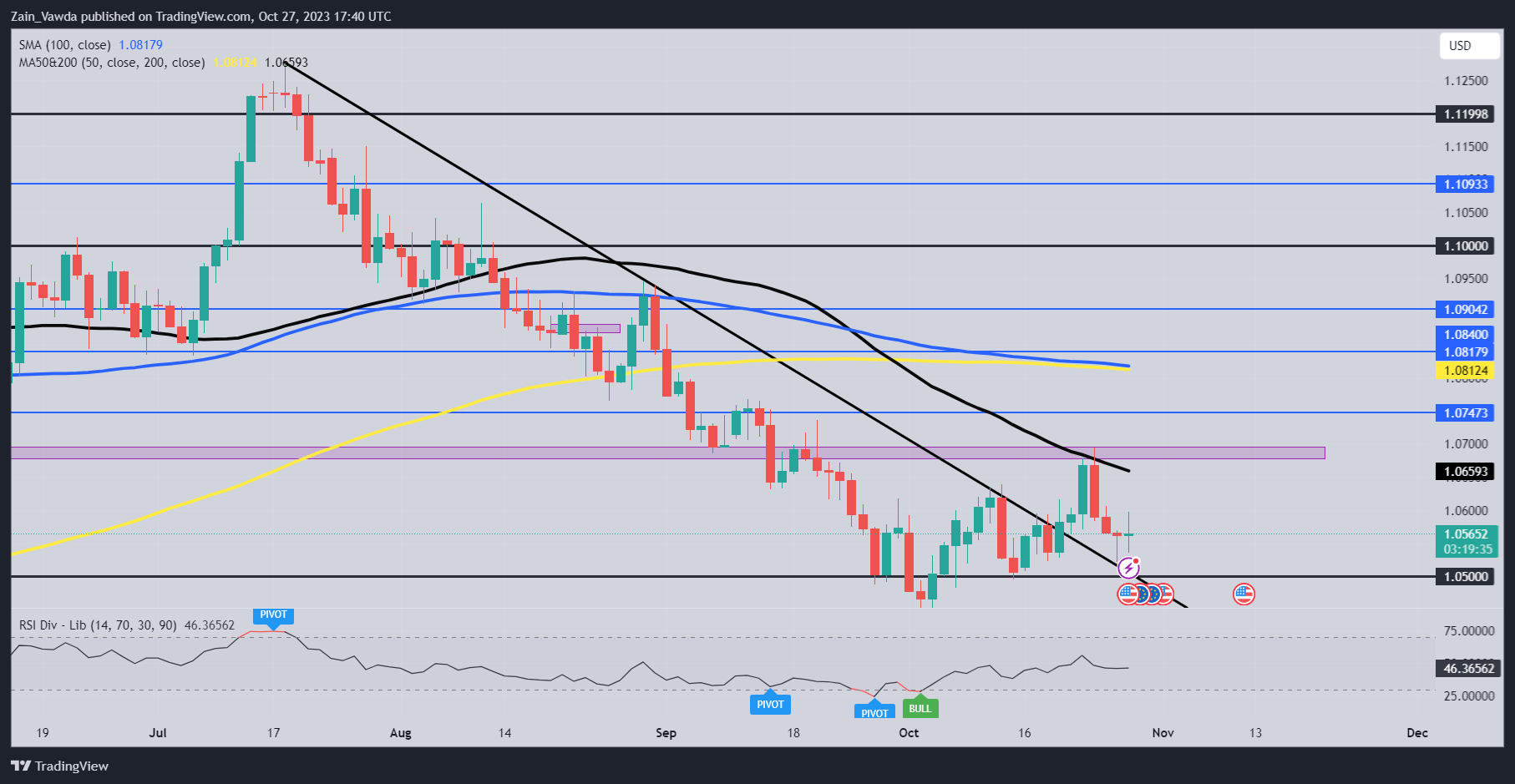

EURUSD is more interesting even with a bunch of fundamentals in the week ahead. Since bottoming out on October 4 around the 1.0450 mark we have printed higher highs and higher lows while breaking the long-term descending trendline which was in play since the Mid July highs.

Friday's daily candle looked set for a hammer close which would have resulted in a morningstar candlestick pattern and making a recovery toward the 1.0700 mark look more appealing. However, the US Dollar seems to be getting a bid late on Friday as Israel has officially announced a ground invasion into Gaza ramping up the risk of a wider conflict. This is helping the US Dollar thanks to its safe-haven appeal. This now adds a further dimension for the pair heading into next week and is a risk that cannot be ignored.

If EURUSD is able to hold above the 1.0500 mark then a return to resistance around the 1.0700 mark may be achievable in the week ahead with a break above facing resistance at 1.0747 and the 1.0800 marl respectively. Alternatively, a break below the 1.0500 mark has to navigate support at 1.450 before attention will turn to the 1.0300 mark.

EUR/USD Daily Chart – October 27, 2023

Source: TradingView

| Change in | Longs | Shorts | OI |

| Daily | -10% | 14% | 0% |

| Weekly | -20% | 26% | -3% |

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda