AUD/USD ANALYSIS & TALKING POINTS

- AUD/USD got a lift from some very punchy China manufacturing data

- But its gains have faded out

- Next week’s Reserve Bank of Australia policy meeting is in focus

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

The Australian Dollar looks a little weaker on Thursday, having failed to hold on to gains made in the previous session on perky Chinese economic data.

China’s official manufacturing Purchasing Managers Index came in at its highest for ten years, raising hope the world’s number two national economy is getting its vigor back at last post-Covid. This was good news for the Australian Dollar, of course, as Australia is a major Chinese trading partner.

Australian inflation data was weaker than expected but still clearly elevated enough at 7.4% to keep further interest rate increases from the Reserve Bank of Australia very much in prospect. The Australian Dollar’s home economy grew by less than expected in the last three months of 2022, according to figures released on Wednesday. Its 0.5% quarterly rise was less the 0.8% economists had been looking for but, given that the RBA’s efforts to slow inflation are bound to trim growth, this modest level of expansion, with recession avoided, will likely be enough for the central bank.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Overall the Australian economy’s fortunes look very similar to that of other developed economies and, given the prospect of further rate rises, should provide the Australian Dollar with some support.

The next major event for the Australian Dollar will be the RBA’s rate setting meet on March 7. Futures markets currently suggest a 95% chance that rates will then rise by a quarter of a percentage point to 3.6%. Markets are currently looking for rates to top out at 4.2% by August of this year.

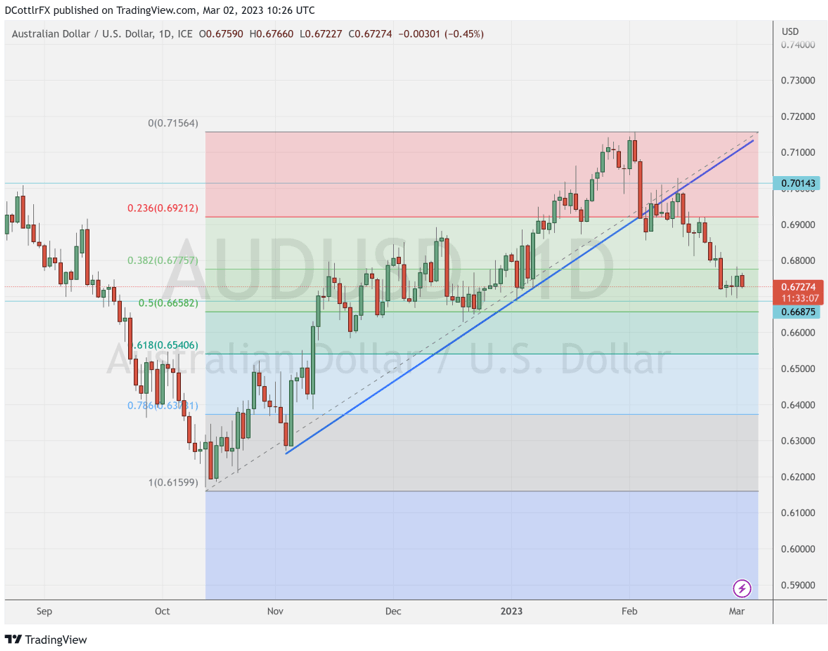

Australian Dollar Technical Analysis

Chart Compiled Using TradingView

Wednesday’s data driven rally appears to have turned back at the market’s 200-day moving average which comes in at 0.67918. This now endures as near-term resistance.

More broadly, AUD/USD’s daily chart shows signs of a classic ‘head and shoulders’ formation which could spell more trouble for AUD bulls. The uptrend from early November has been conclusively broken by the price action of the last two weeks, which has taken AUD/USD down through both the first and second Fibonacci retracements of its rise up to February’s highs from the lows of October, 2022. Now the early January low of 0.66875 appears to offer near-term support ahead of the next retracement level which comes in at 0.66582.

IG’s own sentiment data suggest that the Aussie may have suffered enough for now, however, with 70% of traders bullish at current levels.

--By David Cottle for DailyFX