POUND STERLING ANALYSIS & TALKING POINTS

- UK GDP compounds problems for GBP after yesterday’s jobs report.

- US CPI in focus later today.

- Bear flag break brings 200-day MA into consideration.

GBPUSD FUNDAMENTAL BACKDROP

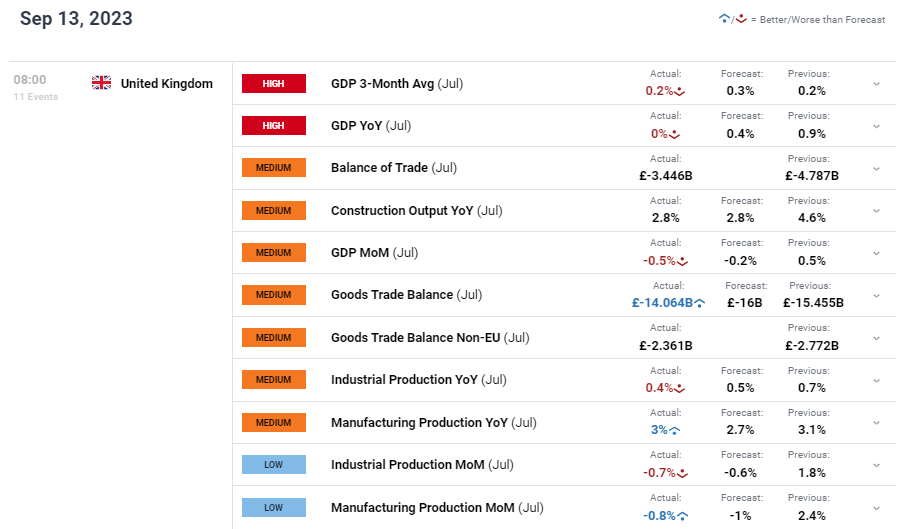

The British pound looks to enter the European trading session on the backfoot after UK GDP (see economic calendar below) missed on both 3-month average and YoY figures respectively. The MoM print is quite surprising in that the economy contracted by 0.5% (quickest pace in 7 months!) as opposed to the 0.2% expected. In contrast to the prior print, the UK economy seems to be slowing despite some positives in manufacturing and trade balance figures. A high interest rate environment is clearly weighing on economic growth. Yesterday UK labor data showed some weakness as well which has supplemented today’s downside move post-GDP.

GBP/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

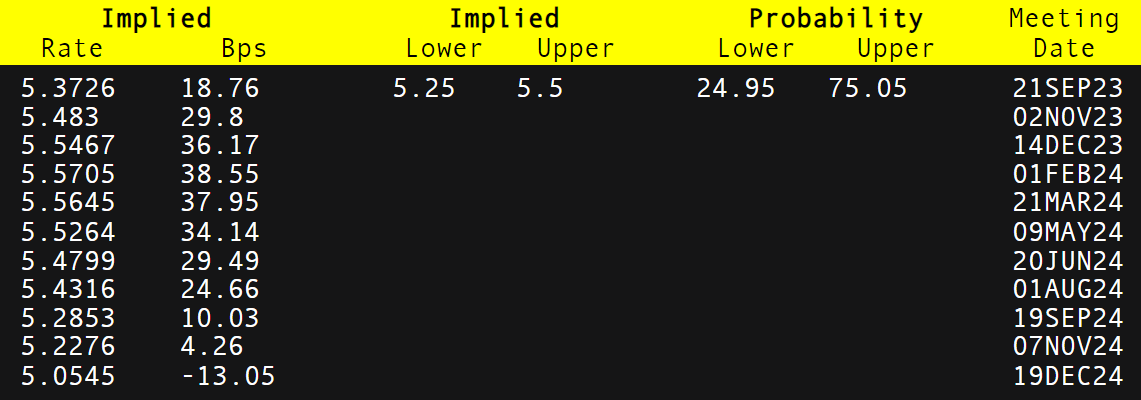

Bank of England (BoE) market expectations (refer to table below) did not see any material change and remain in favor of a 25bps rate hike later this month. All eyes now shift to US CPI later today with any upside surprise likely taking out key support zones on GBP/USD.

BANK OF ENGLAND INTEREST RATE PROBABILITIES

Source: Refinitiv

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

TECHNICAL ANALYSIS

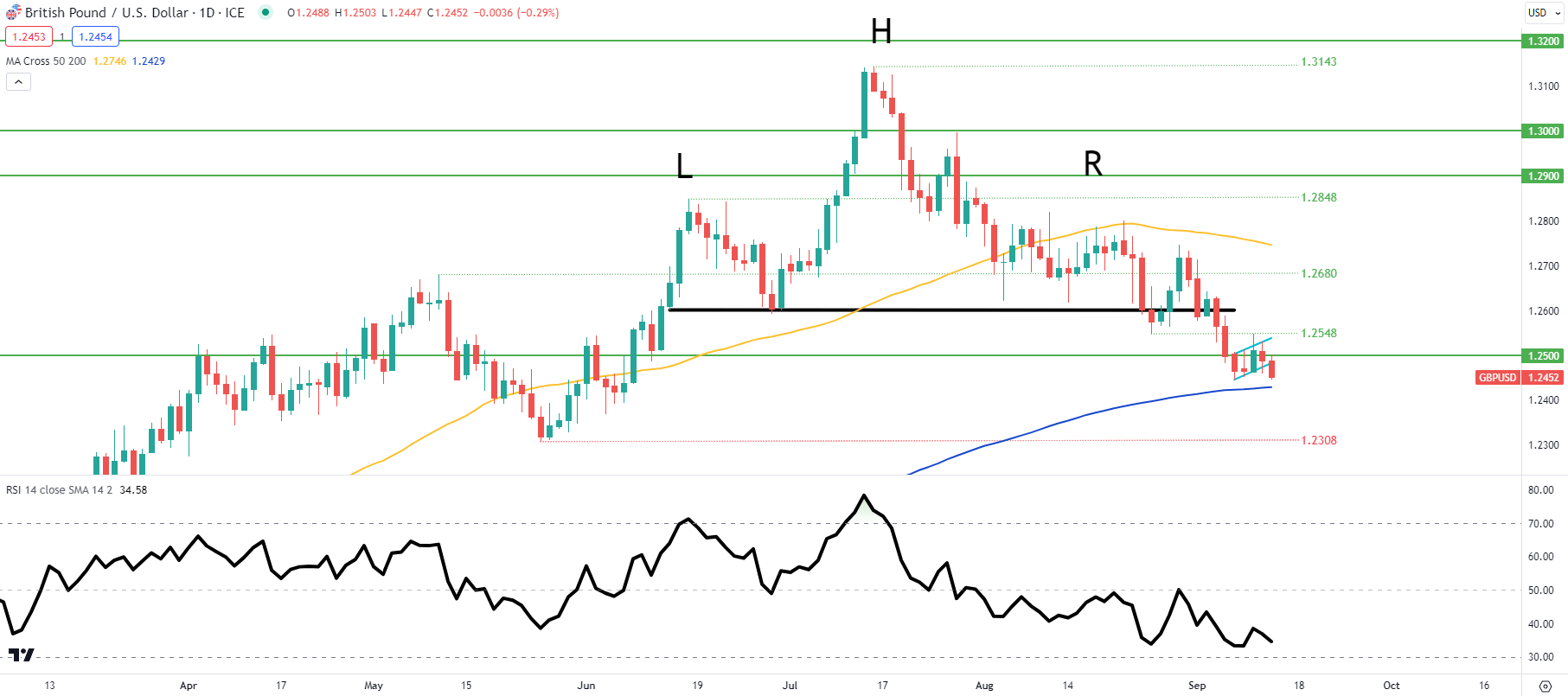

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Price action on the daily cable chart has broken below bear flag support (light blue) as bears push towards the all important 200-day moving average (blue) as mentioned in my IG risk event for the week. A daily confirmation close is still required to confirm the breakout, placing more importance on US CPI.

Key resistance levels:

- 1.2680

- 1.2548

- 1.2500

Key support levels:

- 200-day moving average (blue)

- 1.2308

BEARISH IG CLIENT SENTIMENT (GBP/USD)

IG Client Sentiment Data (IGCS) shows retail traders are currently net LONG on GBP/USD with 65% of traders holding long positions (as of this writing).

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect GBP/USD sentiment and outlook!

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas