Nvidia (NVDA), Nasdaq 100, US Dollar Charts and Analysis

- Nvidia now worth USD2.8 trillion after latest rally.

- US dollar and gold tread water ahead of Friday’s Core PCE release.

For all economic data releases and events see the DailyFX Economic Calendar

Nvidia's stock surged by 7% overnight as the AI chip behemoth continues its relentless post-earnings rally. This rally has catapulted Nvidia to a market capitalization of just over $2.8 trillion, cementing its status as the third-largest company in the world by market capitalization. The AI titan is now closing in on tech mega-stocks Apple ($2.9 trillion) and Microsoft ($3.2 trillion).

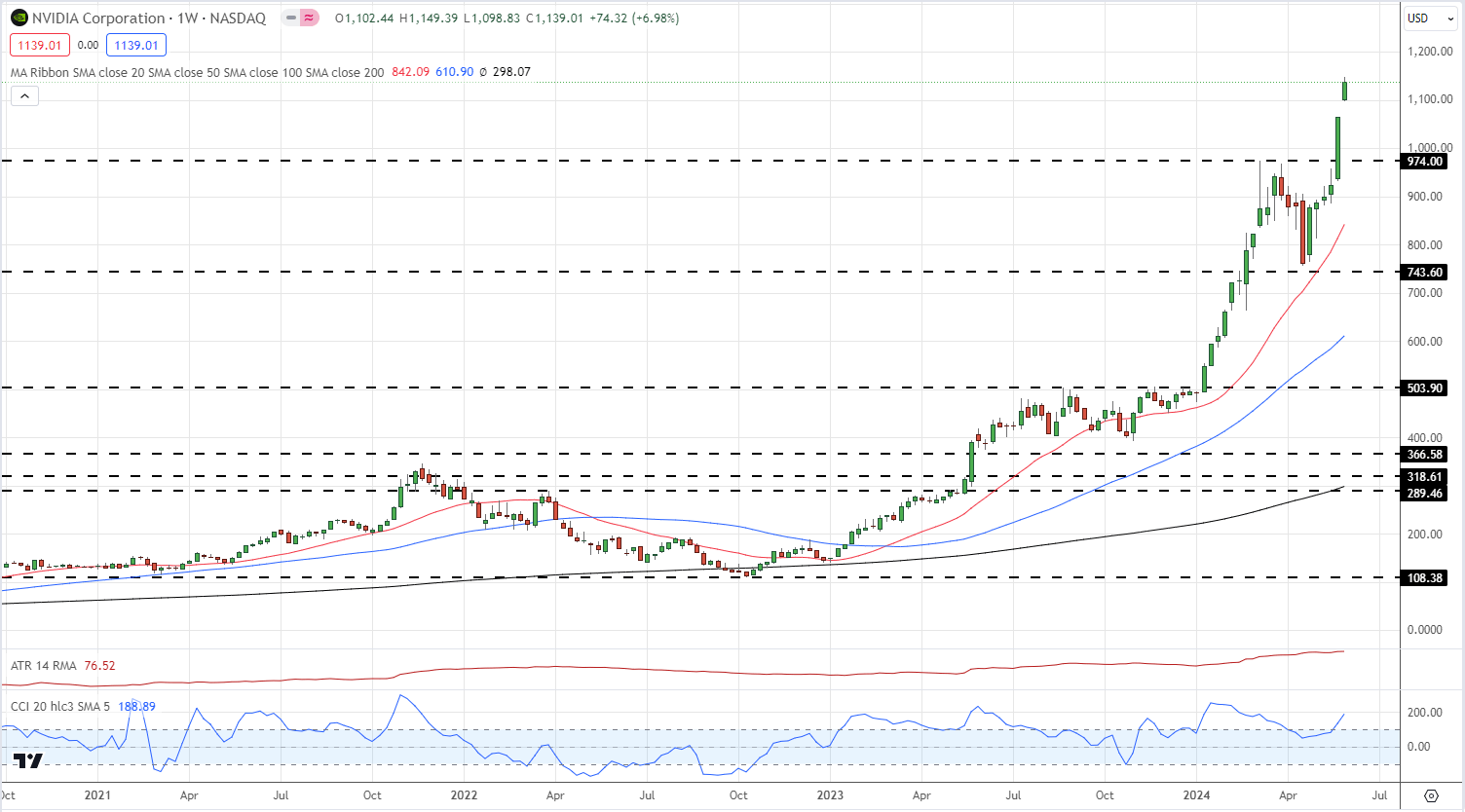

Nvidia's chips have become indispensable workhorses for powering cutting-edge artificial intelligence applications, fueling insatiable demand, and propelling the company's stratospheric ascent. The chip giant's rally has been nothing short of blistering since breaching the $500 level at the start of 2024, with the late-March/early-April sell-off retraced quickly as the stock continues defying gravity.

Nvidia (NVDA) Weekly Chart

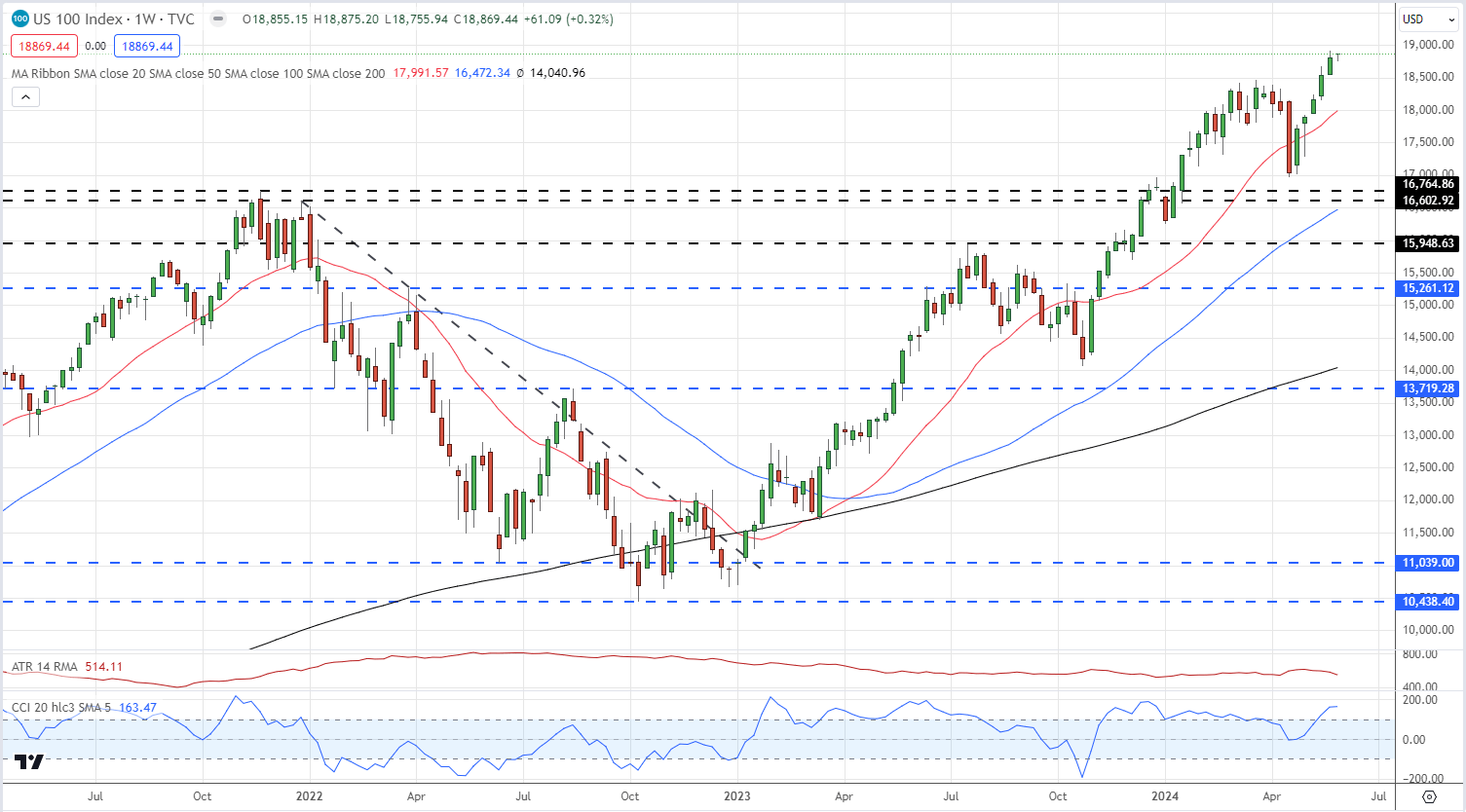

Nvidia has a 7.2% weighting in the Nasdaq 100 and last night’s rally helped the tech index hit a fresh closing high.

Nasdaq (NDQ) Weekly Chart

Charts via TradingView

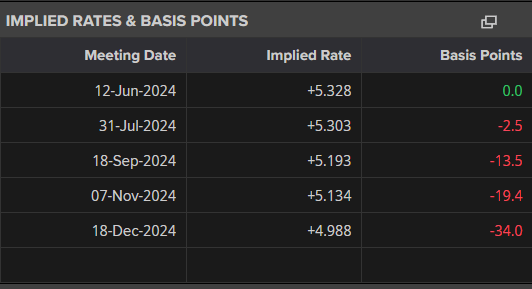

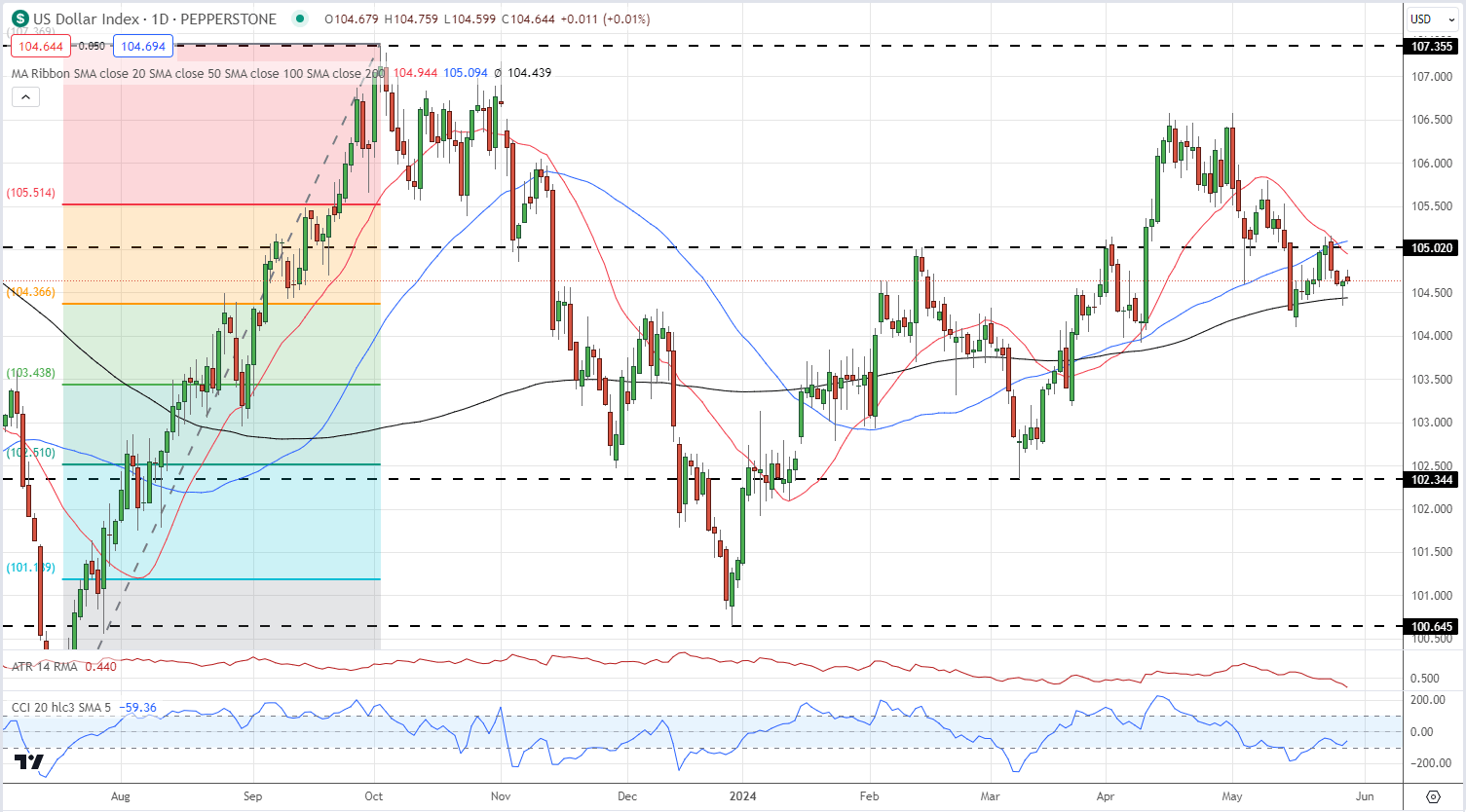

The US dollar is treading water, with traders sidelined and hesitant to take any new positions ahead of this Friday's pivotal US Core PCE inflation release. Persistent stickiness in US inflation has forced financial markets to drastically recalibrate rate cut expectations for 2024, with only a single 25 basis point cut now fully priced in, a far cry from the six cuts anticipated at the end of last year.

Minneapolis Fed Reserve President Neel Kashkari yesterday said that the US central bank should wait for ‘many months of positive inflation data’ before looking to cut rates’, adding that if inflation remains elevated, rate hikes cannot be ruled out. Kashkari’s comments underscore the Federal Reserve's unwavering commitment to bringing down inflation, even at the potential cost of short-term economic pain. With price pressures proving more persistent than initially anticipated, policymakers appear steadfast in their determination to restore price stability, regardless of the implications for financial markets.

The US Dollar Index is flat in early turnover with a slight downside bias. Initial support is seen at 104.44 (200-dsma) ahead of 104.37 (38.2% Fibonacci Retracement).

US Dollar Index Daily Chart

Chart via TradingView

Are you risk-on or risk-off ?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.