Production Cuts & China Stimulus Hopes Supportive for Oil

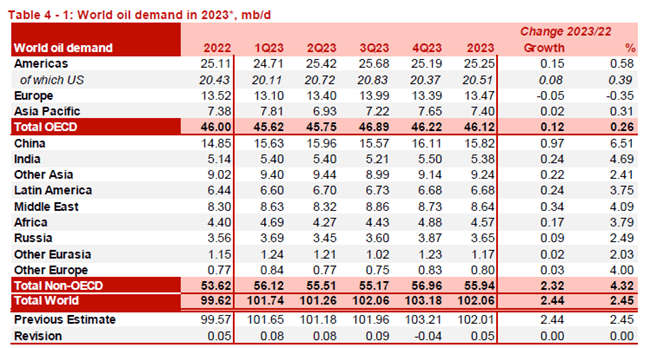

Crude oil prices have rallied since the beginning of July 2023 with prices hitting fresh yearly highs on both Brent and WTI crude respectively. Upside is largely due to OPEC’s announcement to maintain production cuts through to the end of 2023 – agreed by both Saudi Arabia and Russia. A major driving force for this decision may have been the lower revisions in oil demand as represented by the OPEC September 2023 monthly oil market report.

OPEC World Demand Forecast

Source: OPEC

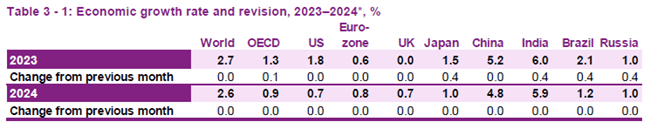

Global economic growth concerns (refer to table below) have been the primary driver for the decline in oil demand forecasts with China and the euro zone leading the way. Many nations are facing 'stagflationary' environments with high interest rates and elevated inflation. The tight monetary policies adopted by most global central banks has slowed consumer and business activity but with hopes pinned on China to re-emerge after recent weak economic data through stimulus measures, oil prices may remain buoyed should these measures bear fruit.

Economic growth rate and revision, 2023 - 2024

Source: OPEC

From a US production perspective, US rig counts have been on the decline with production following suit. Another supporting factor for the price of oil but OPEC+ will surely be monitoring price action closely to not overheat crude oil prices and cause a large decrease in demand coupled with limited supply (demand destruction).

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Where to Next for the USD?

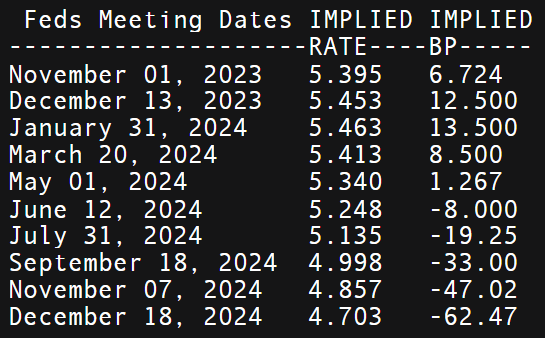

The uS dollar remains buoyed by the fact that the Federal Reserve has delivered a hawkish message after holding rates constant in the September meeting. Markets now expect elevated rates for a longer period before looking to ease monetary policy in mid 2024 (refer to table below). Despite this, oil prices have rallied and should the greenback slip due to moderating inflation and a weaker labor market (presently showing no signs of fragility) then crude oil may push higher.

Implied Fed Funds Futures

Source: Refinitiv, Prepared by Warren Venketas