UK Earnings, Employment Analysed

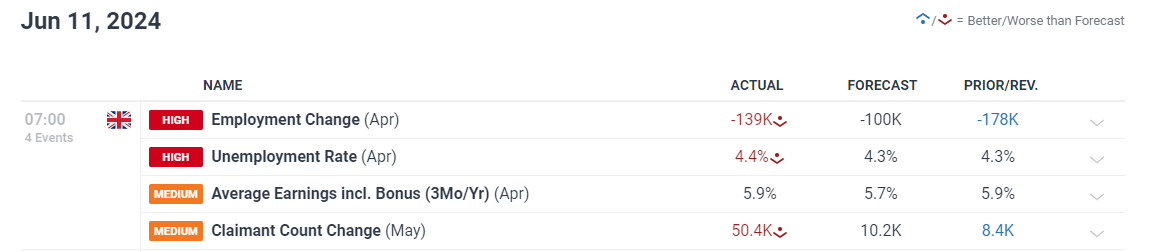

- Unemployment rate ticks higher to 4.4% as 50k jobs were shed in May

- Average earnings inclusive of bonuses rose to 5.9% from 5.7%

- Bank of England due to set policy next week and potentially lay the groundwork for a rate cut in the second half of the year as inflation heads lower overall

UK Job Market Eases Further While Wages Remain Persistently High

The UK job market showed further signs of vulnerability after May witnessed the highest claimant count (application for unemployment benefits) since February 2021. Restrictive monetary policy has helped bring inflation down in a notable fashion but the labour market is feeling the effects.

In the three-month period ending in April, employment contracted by 139k (-100k expected) which follows on from a loss of 178k in the three months prior to that.

Average weekly earnings in April rose to 5.9%, proving a sticky data point for the Bank of England to contemplate ahead of next weeks policy setting meeting. However, the Bank has previously expressed it is no longer looking at earnings data as a major contributing factor to inflation pressures, meaning the overall decline in broader measures of inflation are likely to point the Monetary Policy Committee (MPC) towards an eventual rate cut towards the latter stages of the year.

Customize and filter live economic data via our DailyFX economic calendar

Learn how to prepare for high impact economic data or events with this easy to implement approach:

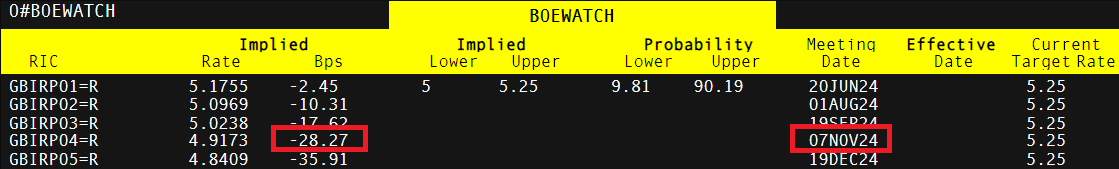

Market pricing reveals an expectation of one, maybe two rate cuts this year – much like the Fed – with November expected to be the month of interest while September remains a possibility if the data becomes increasingly more dovish (lower CPI, higher unemployment rate, low/contracting growth).

Implied BoE Basis Point Cuts into Year End

Source: TradingView, prepared by Richard Snow

Market Reaction

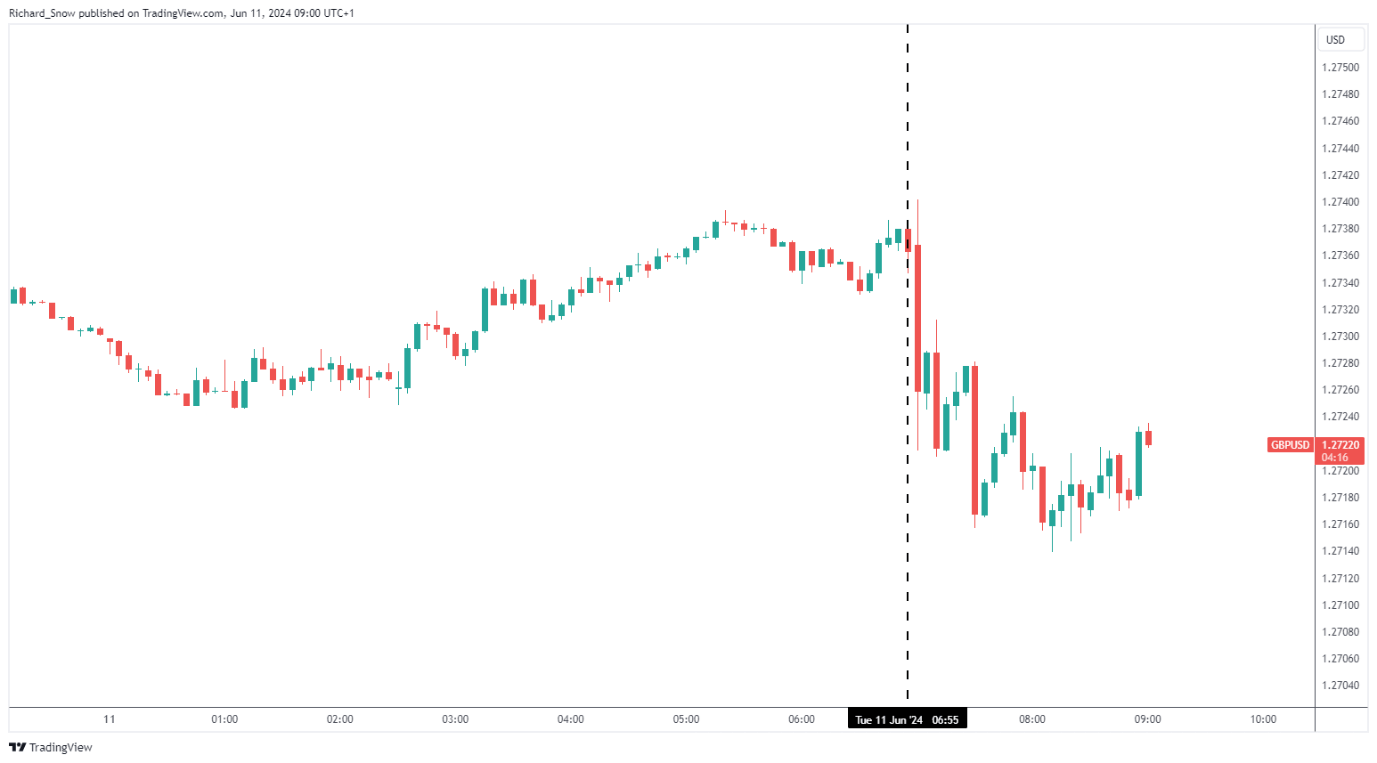

Cable understandably dropped in the wake of the data, with the unemployment rate and May claimant data presenting a worrying picture but the reaction appears limited ahead of major US event risk still to come tomorrow (CPI, FOMC).

GBP/USD 5-minute chart

Source: TradingView, prepared by Richard Snow

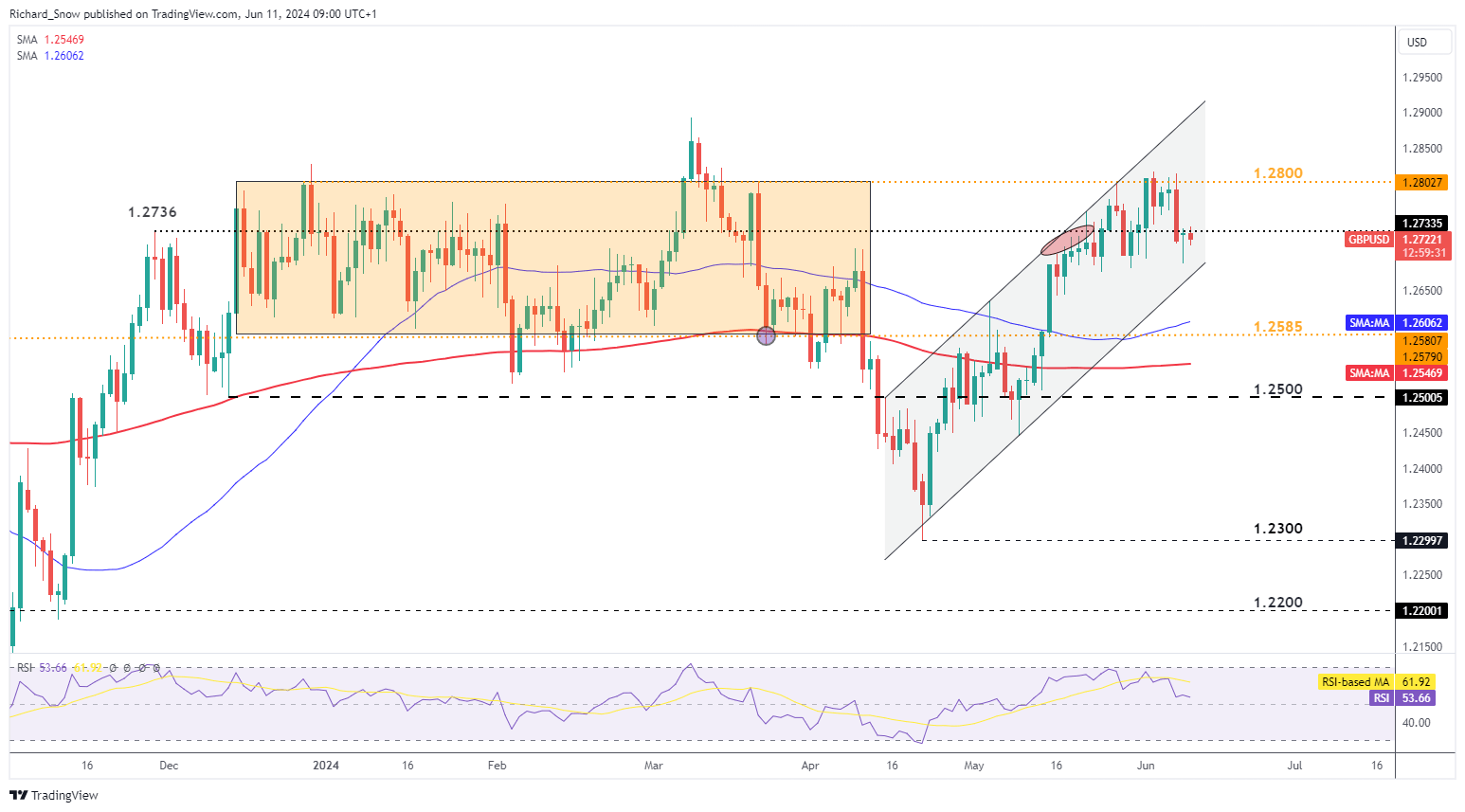

The UK data has helped extend the bearish GBP/USD move that developed in the wake of Friday’s massive NFP shock that sent the dollar higher. Understandably, moves are contained ahead of the main event of the week (FOMC) with he Fed due to update its dot plot projection of the Fed funds rate by year end. Many expect an upward revision in the dot plot (fewer rate cuts). The question now is whether stubborn inflation data in the US, alongside a resurgent jobs market will be enough to erase two or just one rate cut from the yearly outlook.

GBP/USD trades below the 1.2736 swing high from the end of last year, opening up channel support as the next level of support. To the upside, 1.2800 produces a clear level of resistance, capping prior advances.

GBP/USD Daily Chart

Source: TradingView, prepared by Richard Snow

Discover the power of crowd mentality. Download our free sentiment guide to decipher how shifts in GBP/USD's positioning can act as key indicators for upcoming price movements.

| Change in | Longs | Shorts | OI |

| Daily | -20% | 29% | 2% |

| Weekly | -7% | 2% | -2% |

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX