Oil (WTI) Talking Points

- Prices say early gains after Tuesday’s shock US inventory drawdown

- But they haven’t lasted

- There’s more stockpile data still to come Wednesday

- Get your hands on the Oil Q2 outlook today for exclusive insights into key market catalysts that should be on every trader's radar:

US Crude oil prices failed to hold on to early gains in Europe on Wednesday but the market’s recent range held firm.

Energy markets had found support into the open thanks to data released in the previous session showing a surprisingly strong drawdown in us crude stockpiles. The American Petroleum Institute said that inventories fell by 3.01 million barrels in the week ending May 10. This was more than double market expectations and a big turnaround from the half-million-barrel stock build seen in the previous week.

Still, this market continues to fret about end-demand levels in what looks like a well supplied market despite long-running and ongoing production cuts by the Organization of Petroleum Exporting Countries and its allies. The International Energy Agency cut its 2024 oil-demand forecast on Wednesday. It now sees an average of 1.1 million barrels per day, a reduction of 140,000 barrels.

There remains considerable uncertainty about when interest rates could start to fall in the United States, and elsewhere in the industrialized world. Inflation seems to be heading broadly in the direction policy makers would like. But, as US producer prices showed this week, there can be bumps in the road lower, and central banks will need to be certain they have inflicted long-term damage on pricing power before they can relax interest rates.

Still, the underlying resilience of the US and other economies isn’t necessarily bad news for energy consumption. Conflict in Ukraine and Gaza sadly continues to put a floor under prices. There’s also a wildfire close to Fort McMurray, a key location or Canadian oil sand production. Worries about continuity of supply from there are also propping up the market.

There’s more oil-specific data coming up on Wednesday when the Energy Information Administration releases its own inventory numbers.

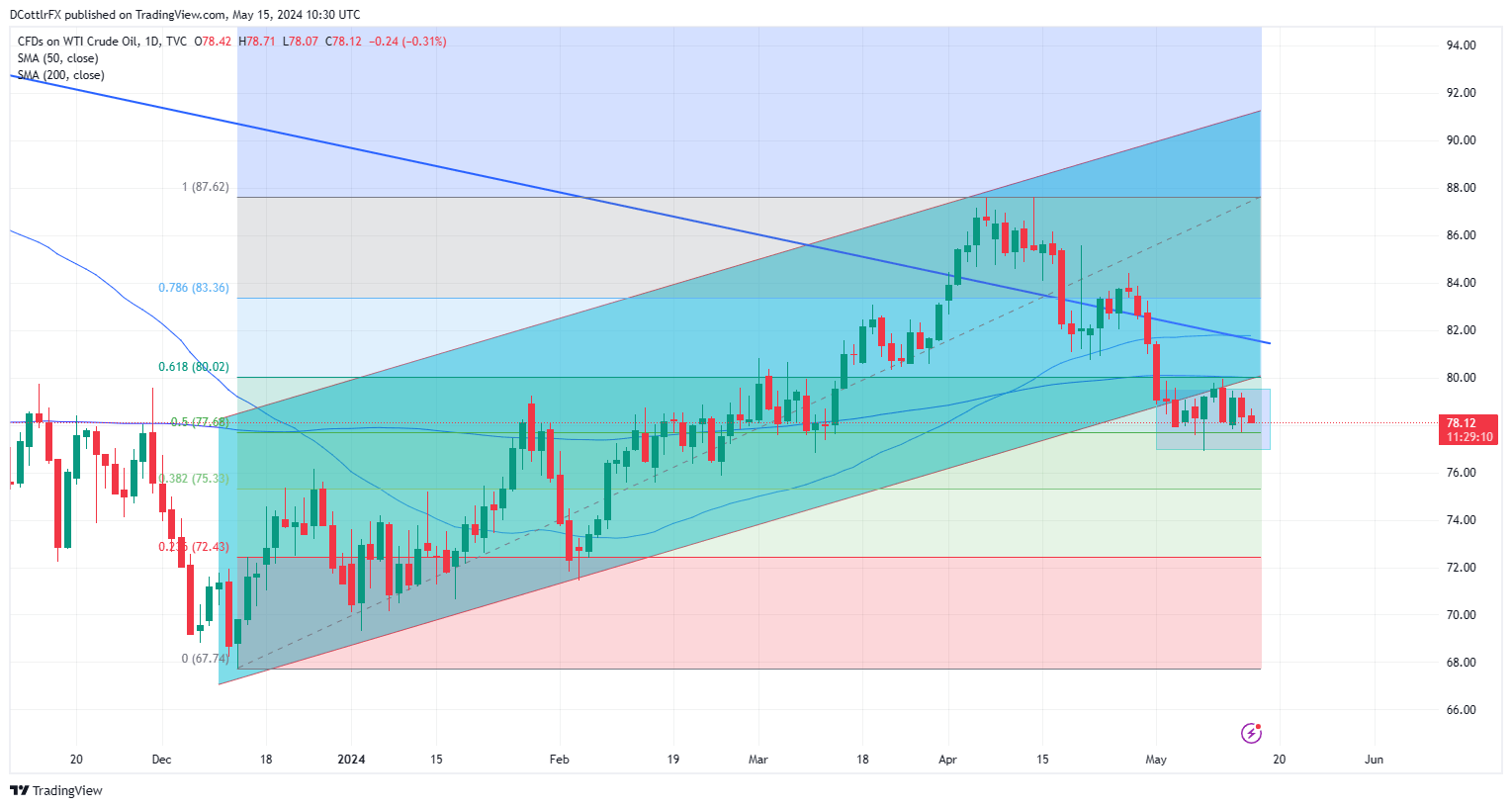

US Crude Oil Technical Analysis

West Texas Intermediate Daily Chart Compiled Using TradingView

| Change in | Longs | Shorts | OI |

| Daily | 7% | -15% | -3% |

| Weekly | -3% | 4% | 0% |

Prices are struggling to remain above psychological support at $78.00, with the bulls just about pressing their case for now.

The market seems to have settled into a range between $79.44 and $76.86, with retracement support above the latter at $7.68 also apparently important.

A downtrend line from mid-2022 is also approaching and is likely to provide a tough barrier when it gets nearer. Still, if current range trade endures it might mitigate the risk that a head and shoulders top is forming for this market, capping the rise from the lows of December last year.

Bulls’ ability to break above and stay above the 50- and 200-day moving averages in the near-term will probably be key to direction. The uncommitted may want to wait and see how that plays out into the end of this week.

--By David Cottle for DailyFX